Business Loans

Ecwitty has financing solutions to help you reach all your business goals. Find the perfect financing to meet your business needs today.

We Make Getting Business Loans Easy

We understand all businesses.

Our professionals are familiar with the everyday difficulties you encounter as a business owner.

We care about more than just your credit score.

We prioritize your application's growth potential over your credit score when evaluating it.

We value personal relationships.

Our lending experts create a trustworthy relationship with every customer.

We understand that managing your business and dealing with a tonne of paperwork involving bank loans must take up a lot of your time and energy. Our streamlined procedure avoids needless paperwork and potentially lengthy decision-waiting times.

Plus, you are free to use the loan funds any way you see fit, regardless of whether you run a construction business or a restaurant launching a new location. Our flexible loan terms and amounts provide options tailored to the needs of your business.

Our Term Loans Enable Businesses To Finance Growth Initiatives

Business term loans are excellent for major purchases and long-term business expansion. Due to their long repayment terms and often lower interest rates than credit cards, they provide you plenty of time to earn a profit before you have to repay your loan.

Short-term business loans

Borrow smaller sums with one or two year repayment terms as a general rule.

Intermediate-term business loans

Take out loans up to $500,000 and the repayment terms range from 2 to 5 years.

Long-term business loans

Access funds worth millions of dollars, with up to 25 years to repay the loan.

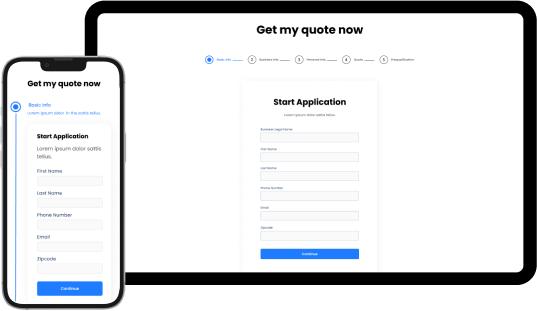

How Do You Get A Business Loan With Ecwitty?

We know you have a business to run. Therefore, we’ve created a streamlined application process that is quick and simple.

Discuss your credit decision and financing options with your personal Funding Specialist.

Receive cash funds as early as one business day after approval for any business need.

How Ecwitty Helps You Reach Your Business Goals

We understand that acquiring business loans can require borrowers to make significant financial commitments. Before making a choice, consider this important question if you believe your business could benefit from financing: “How exactly will I use this loan for my business?”

You might determine a business loan is the best option for you depending on your response. A loan can benefit your business in a variety of ways;

- Relaunching your business.

- Moving on to a new location.

- Making a renovation investment.

- Funding marketing initiatives.