Microloans

What Are Microloans?

Access to capital

Microloans offer access to capital for small businesses not eligible for traditional loans.

Quick approval and funding

A micro business loan offers quick approval and funding times to help you cover urgent expenses.

Supports business growth

Microloans support business growth through access to capital for expansion, equipment, and hiring.

Microlending is a small loan designed for individuals and small businesses that may not have access to traditional bank loans. Small business owners can take out microloans up to $50,000. These microloans for small businesses are designed to provide financial assistance for specific needs, such as starting a business, covering unexpected expenses, or financing small projects. Micro small business loans often have more relaxed eligibility requirements compared to traditional bank loans and can be approved and funded quickly.

Check Your Short-Term Loan Rate

Our loan calculator allows you to estimate payments and choose a loan amount to make a well-informed financial decision.

Benefits Of Microloan For A Business

Microloans for startup businesses can be beneficial in terms of credit building and progression to better funding alternatives. They are a favorable option for underrepresented groups such as microloans for women, minorities, veterans, and others who have faced challenges in securing funding by understanding the SBA microloan requirements in the past.

Borrowing Power

Starts at $$ up to $$

Flexible loan terms

Repay the loan over a term of year to year.

Quick Funding Time

Get your funds within 24 hours of applying.

Why Choose Ecwitty For Instant Microloans?

At Ecwitty, we are dedicated to helping small business owners like you obtain the funds and resources necessary for business growth. Our goal is to eliminate the finance gap faced by countless small businesses and help micro lenders pave the way for their success.

We provide micro business loan solutions that include SBA microloans that are usually a good fit for any small, short-term use of capital, including the following:

- Starting a new business.

- Working capital to buy inventory or supplies.

- Covering payroll or training employees.

- Covering small business micro loans.

- Funding a new marketing strategy.

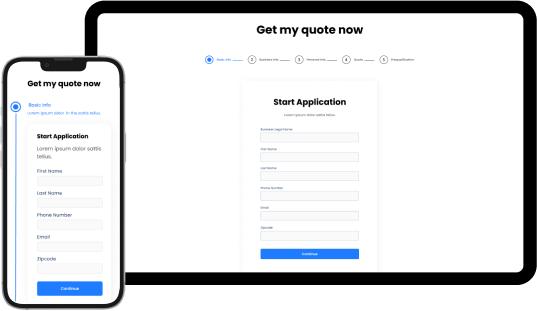

How To Apply For Micro Business Loans With Ecwitty?

We know you have a business to run. Therefore, we’ve created a streamlined application process that is quick and simple.

Discuss your credit decision and micro loans options with your personal Funding Specialist.

Receive cash funds as early as one business day after approval for any business need.