Computer Repair Shop Loans

If you’re a computer repair business looking for fast funding, our computer repair shops loan can be the ideal solution! These business loans for a computer repair business provide up to $$ in just x days. With this rapid capital infusion, small businesses are well-equipped to manage their funds and meet urgent needs.

What Are Small Business Loans For Computer Repair Shops?

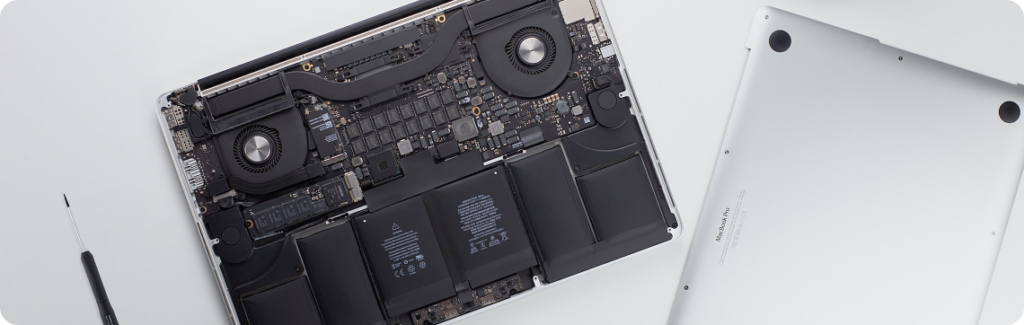

Small business loans for computer repair shops are financial products specifically designed to provide funding to small business owners who run computer repair shops. With the right computer repair shop loan, entrepreneurs can purchase or upgrade equipment, hire additional staff, obtain competitively priced materials and services, and invest in marketing and other necessary expenses.

Our business loan for computer repair shop funds is also a great way to cover short-term working capital needs, such as operational costs or unexpected expenses. With access to the right type of loan, computer repair shop owners can take their business to new heights and provide customers with unbeatable service.

At Ecwitty, we offer a car dealership loan with no credit check, making accessing capital easier than ever! We understand that bad credit is something many people struggle with; however, this doesn’t mean you won’t be able to make payments on the loan and get back on track financially.

Check Your Computer Repair Shop Loan Rate

Our loan calculator allows you to estimate payments and choose a loan amount to make a well-informed financial decision.

Financing Options We Offer For Your Computer Repair Business Loan

1. Short-Term Loans: A computer repair shop loan that provides a lump sum of capital, which can be used for any business-related expenses, including the purchase of inventory, equipment, and supplies. Apply for a Short-Term Business Loan.

2. Line of credit: A computer repair shop loan that provides ongoing access to capital, which can be used as needed, and is typically secured by a lien on business assets. Apply for a Business Line Of Credit.

3. Merchant cash advance: A computer repair shop loan that provides an advance against future credit card sales, which can be used for business-related expenses. Apply for a Merchant Cash Advance.

4. SBA loan: A computer repair shop loan guaranteed by the Small Business Administration and provides financing for a wide range of business purposes, including the purchase of equipment, working capital, and real estate. Apply for an SBA Loan.

How To Get A Computer Repair Business Loan With Ecwitty?

Applying for computer repair shop loans with us is as easy as 1, 2, 3!

Apply in minutes

We know you have a business to run. Therefore, we’ve created a streamlined application process that is quick and simple.

Talk to a lending expert

Discuss your credit decision and financing options with your personal Funding Specialist.

Receive funds in your account

Receive cash funds as early as one business day after approval for any business need.

Why Choose Ecwitty?

With a decade of expertise in assisting all kinds of businesses in obtaining the funding they need, Ecwitty can provide you with the right financing option for your business. Unlike most traditional lenders who have lengthy applications for a business loan for computer repair shops, our straightforward online form means you can promptly get a loan approved and return to offering top-notch repair services to your customers. Our quick application offers peace of mind that you’ll have access to the funds necessary when it matters most!