Unsecured Business Loans

Unlock the potential of your business with unsecured business loans to maximize your cash flow – no collateral is needed! Our unsecured small business loans are designed for convenience, featuring competitively low rates and flexible repayment terms.

What Are Unsecured Business Loans?

Quick Funding

The application process for these loans is typically much faster than for secured business loans.

Flexibility

Get more flexibility in terms of repayment, allowing you to tailor the loan to your specific needs.

Low Interest Rates

Enjoy lower interest rates than other types of loans, making them a great option for businesses looking to save money.

Unsecured business loans offer businesses the opportunity to access funds without needing to provide any collateral. This makes them a great option for those who don’t have the necessary assets to secure a loan from more traditional lenders. Long-term unsecured business lending is available in a number of different forms, including lines of credit, merchant cash advances, invoice financing, and more. They’re also typically easier to obtain than secured loans due to the lack of collateral required, making them a great option for businesses that need cash fast.

How Do Unsecured Business Loans Work?

Our unsecured business loans for startups work by providing businesses with financing that is not backed by collateral. Instead, we assess the creditworthiness of your business and its ability to repay the loan based on factors such as the business’s financial history, revenue, and credit score.

Borrowing power

Starts at $$ up to $$

Flexible loan terms

Repay the loan over a term of year to year.

Quick Funding Time

Get your funds within 24 hours of applying.

Secured vs. Unsecured Business Loans

How Can I Use My Unsecured Business Loan?

- Businesses can use unsecured loans to cover everyday operating expenses, such as rent, utilities, and payroll.

- Unsecured loans can purchase inventory, equipment, or supplies, helping businesses grow and expand.

- Can use unsecured loans to fund marketing and advertising campaigns, helping to increase brand recognition and attract new customers.

- Unsecured loans can be used to fund the expansion of a business, such as opening a new location or adding a new product line.

- Businesses can use unsecured loans to consolidate high-interest debt, potentially reducing monthly payments and overall interest costs.

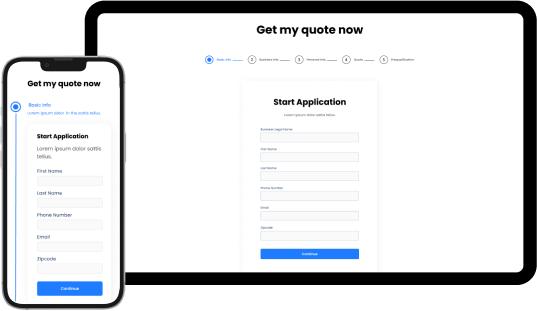

How To Apply For Unsecured Business Loans With Ecwitty?

We know you have a business to run. Therefore, we’ve created a streamlined application process that is quick and simple.

Discuss your credit decision and financing options with your personal Funding Specialist.

Receive cash funds as early as one business day after approval for any business need.