Merchant Cash Advance

Facing revenue fluctuations? With merchant cash advances, we modify remittances to better match your monthly revenue so you can grow your business worry-free.

What Is A Merchant Cash Advance?

A merchant cash advance, or MCA, is a type of financing where a business takes out a loan against the proceeds of potential future sales. This money is not a loan with a set duration and interest rate that must be repaid. It is actually an advance that your business will pay back with a portion of its future revenues.

A merchant cash advance for a small business is a transaction with no interest or APR (annual percentage rate); they are not business loans. Unlike when taking out a small business loan, receiving an advance does not put your business into actual debt.

What is HoldBack

pellentesque sit amet porttitor eget dolor morbi non arcu risus quis varius quam quisque id diam vel quam elementum pulvinar etiam non quam lacus suspendisse faucibus interdum posuere lorem ip vel elit scelerisque mauris pellentesque pulvinar pellentesque habitant morbi tristique seetra convallis posuere morbi leo urna molestie at elementum eu facilisis sed odio morbi quis commodo odio aenean sed adipiscing diam donec adipiscing tristique

Which Type Of Businesses Can Benefit From MCA?

Quick Funding Time

Get your funds within 24 hours of applying.

No collateral needed

MCAs don’t require physical collateral

Use advance as you want

How you spend the money for your business is entirely up to you.

Businesses looking to finance a lucrative revenue-generating opportunity, such as the bulk purchase of merchandise with a short turnaround time, greatly benefit from getting a merchant cash advance. It is also an excellent financing option for businesses that need to borrow money to increase their operating capacity by purchasing equipment or hiring more employees during the busiest times of the year. MCAs are often used to fund growth opportunities that boost a business’s revenue.

Grow Your Small Business With Us

All businesses need to have access to funding and capital. However, applying for financing can be difficult for small businesses due to the limited options and lengthy application procedures for traditional loans.

Fortunately, our merchant cash advance company has options that can help you bridge the gap. We make it easy for business owners to qualify for an MCA because you don’t need a long business history; we’re committed to helping small businesses reach their full potential.

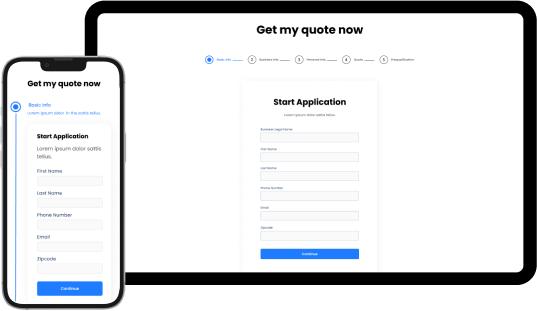

How to Apply for Merchant Cash Advance

We know you have a business to run. Therefore, we’ve created a streamlined application process that is quick and simple.

Discuss your credit decision and financing options with your personal Funding Specialist.

Receive cash funds as early as one business day after approval for any business need.

Why Ecwitty?

Ecwitty understands that you are more than simply your credit score and income statement, so while evaluating your application, we take into account your potential for growth and the overall health of your business. Regardless of what industry you work in, our trained Funding Advisors will work with you to choose the best financing option that will enable you to expand your business without compromising cash flow.

Borrowing Power

Find out how much you could borrow.

Terms & Rates

Find out what terms and charges you can expect from us.

Complete security

Your personal information is kept fully private.

Who Should Apply For A Merchant Cash Advance?

A merchant cash advance can be the best source of funding for some businesses, such as;

- Businesses with a low credit score.

- Newer businesses with a short credit history.

- Businesses that require immediate cash.