Commercial Real Estate Loans

Our commercial real estate loans enable businesses to purchase, renovate, or refinance owner-occupied real estate to increase the value of their small business and alleviate leasing uncertainty.

What Is A Commercial Real Estate Loan?

Borrowing power

Starts at $$ up to $$

Flexible loan terms

Repay the loan over a term of year to year.

Low interest rates

The interest rate depends on the amount borrowed, typically ranging from % to %.

A commercial real estate loan, also known as a commercial mortgage loan, is utilized to finance the acquisition of an available space for your business or a plot of land where you want to construct your business’s new location. You cannot buy residential homes with these loans because they are only intended for business real estate.

Along with covering costs for new real estate property, this loan can also be used to refinance or renovate existing business real estate.

Commercial Real Estate Loan Terms To Get Your Finances In Order

Just like any other loan, the types of loans and interest rates you qualify for will be significantly influenced by your present financial condition and credit history. Although each person’s exact requirements for obtaining real estate loans will differ, some common commercial real estate loan requirements are:

Credit score

Businesses with a credit score of 600 or higher.

Monthly earnings

Your business’s monthly revenue must be at least $$.

Time in business

Your business should be operating for at least xx months or more.

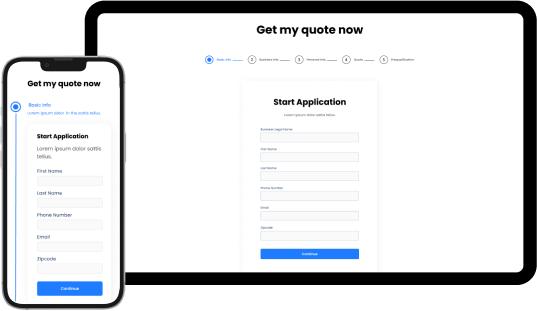

How To Get A Commercial Real Estate Loan With Ecwitty?

We know you have a business to run. Therefore, we’ve created a streamlined application process that is quick and simple.

Discuss your credit decision and financing options with your personal Funding Specialist.

Receive cash funds as early as one business day after approval for any business need.

Why Get A Commercial Real Estate Loan?

Every improvement, addition, or remodel increases the value of your property, provides you with the room you need to optimize operations, or draws in more prospects. You can accomplish all of this and more with a commercial real estate loan. Keep in mind that the stakes go beyond mere square footage. You might give your small business a stronger financial and structural start by making a clever financing decision.

- It can be challenging to maintain growth and operation of a highly seasonal business throughout the year. When your cash flow declines, a commercial business loan might help you continue to fund your operation, which can foster growth.

- A commercial business loan provides you with alternative capital while assuring that you keep ownership of your business throughout the repayment period.

- Repayment plans for commercial real estate loans typically last for a number of years, allowing you to concentrate on other crucial business matters like sales, overseeing expenses, and training employees.

- Since commercial real estate loans are long-term, they often have lower interest rates. If you choose to have fixed monthly repayments, you can use them in your business planning and forecasts, allowing you to more confidently structure your company's financing.